The Central Provident Fund (CPF) is a mandatory savings scheme in Singapore that helps residents save for retirement, healthcare, and housing. It is one of the most important financial schemes for Singapore citizens, and Singapore Permanent Residents (PRs).

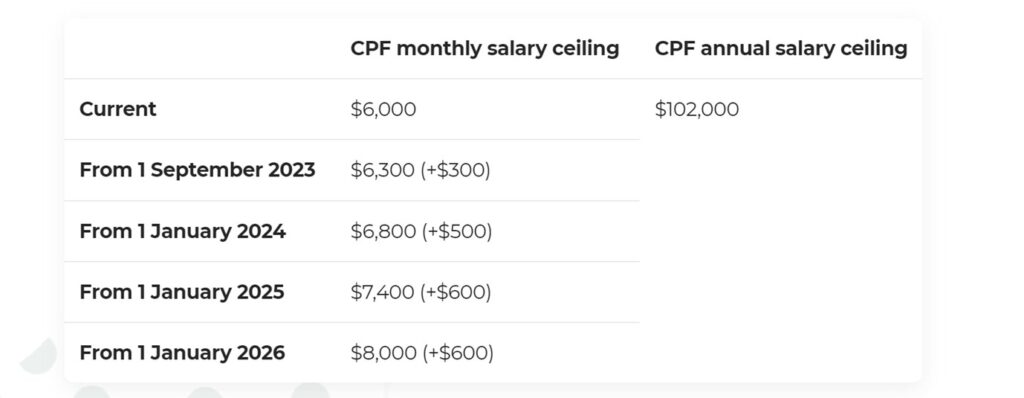

The current CPF monthly salary ceiling stands at S$6,000. Starting from 1 September 2023 to 2026, the CPF monthly salary ceiling will be increased gradually in four steps to reach S$8,000. This adjustment provides both employers and employees ample time to adjust to the new regulations.

Image Source: Central Provident Fund Board (CPF)

However, it’s important to note that the CPF annual salary ceiling of S$102,000 remains unchanged. This means that while more of an individual’s monthly income will be eligible for CPF contributions, there will still be a cap on the total amount of CPF contributions that can be made in a year. Employers and employees should take note of the gradual implementation of these changes and make any necessary adjustments to their CPF contributions accordingly.

In this article, we will explore the CPF system in Singapore and how it works for PRs and Citizens.

Overview of CPF System

The CPF system in Singapore comprises 3 accounts – the Ordinary Account (OA), Medisave Account (MA), and Special Account (SA).

Ordinary Account (OA)

The Ordinary Account is primarily used for housing, education, and investment purposes. Contributions made to the OA can be used for the purchase of a home, payment of education fees, and investment in stocks, bonds, and other financial instruments. The OA has a lower interest rate compared to the other two accounts, but it is the only account that allows CPF members to withdraw their savings for housing and education purposes.

Medisave Account (MA)

The Medisave Account is specifically designed to help CPF members save for their healthcare expenses. Contributions made to the MA can be used to pay for medical expenses for the member and their immediate family members. The MA has a higher interest rate than the OA but a lower interest rate than the SA.

Special Account (SA)

The Special Account is primarily used for retirement savings. Contributions made to the SA have a higher interest rate than the other two accounts, and the money in the SA can only be withdrawn for certain purposes such as investment in approved financial instruments, payment of insurance premiums, and purchasing a home. The SA is an important account for CPF members to accumulate savings for their retirement years, and it is particularly useful for those who do not have other retirement savings plans.

CPF Contribution Rates for Singapore PRs and Citizens

CPF contribution rates for Singapore PRs and Citizens vary slightly. Currently, the CPF contribution rate for Citizens and third year of PRs aged below 55 years is 37% of their gross monthly wages, with the employer contributing 17% and the employee contributing 20%. However, the contribution rate for first and second-year PRs is different. Below is the chart of the breakdown percentage:

| For Singapore PRs | First year | Second year | ||

| By employer (% of wage) | By employee (% of wage) | By employer (% of wage) | By employee (% of wage) | |

| Graduate Employer & Employee | 4 | 5 | 9 | 15 |

| Full Employer & Graduate Employee | 17 | 5 | 17 | 15 |

| Full Employer & Employee | 17 | 20 | 17 | 17 |

For employees aged 55 and above, the CPF contribution rate is lower, depending on the aged. Below is the chart of the breakdown percentage:

| Employee’s age (years) | Contribution rates from 1 January 2023 (monthly wages > $750) | ||

| By employer (% of wage) | By employee (% of wage) | Total (% of wage) | |

| 55 and below | 17 | 20 | 37 |

| Above 55 to 60 | 14.5 | 15 | 29.5 |

| Above 60 to 65 | 11 | 9.5 | 20.5 |

| Above 65 to 70 | 8.5 | 7 | 15.5 |

| Above 70 | 7.5 | 5 | 12.5 |

CPF Withdrawal and Usage

CPF savings can be withdrawn for various purposes, such as the purchase of a home, healthcare expenses, and retirement. However, there are certain rules and restrictions on the withdrawal and usage of CPF savings. For example, CPF savings can only be used to purchase a home that is approved by the Housing and Development Board (HDB) or private residential properties that meet certain criteria. CPF savings can also be used to pay for healthcare expenses for yourself, your spouse, and your dependents.

CPF savings can be withdrawn in full only when you reach the age of 55, and a portion of your savings must be used to purchase an annuity that provides a monthly payout for life. The remaining savings can be withdrawn in a lump sum or kept in the CPF accounts to earn interest.

CPF Schemes and Programs

There are various CPF schemes and programs that help PRs and Citizens save more for retirement, healthcare, and housing. One such program is the CPF Investment Scheme (CPFIS), which allows you to invest your CPF savings in approved financial instruments such as insurance products, fixed deposits, stocks, bonds, and unit trusts. The CPFIS is designed to help you achieve higher returns on your CPF savings, and it comes with various risks and limitations.

Another program is the CPF Retirement Sum Scheme (RSS), which provides a monthly payout for life once you reach the age of 65. You can apply to start receiving payouts at any time after age 65. Payouts will start automatically at 70 if you have not chosen to start earlier. The RSS is designed to provide a steady stream of income in retirement, and it can be used to supplement your other sources of income such as the CPF Life Scheme or personal savings.

CPF Life Scheme is another important program under the CPF system. It is a life annuity that provides a monthly payout for life, starting from the age of 65. If you have S$60,000 in your retirement savings, you will be automatically included in the scheme. If you are not automatically included, you can enroll yourself when you’re ready to start receiving payouts, anytime from 65 to one month before you turn 80. CPF Life Scheme is designed to provide a steady stream of income in retirement, and it is funded by your CPF savings.

Conclusion

The CPF system in Singapore is an important savings scheme that helps PRs and Citizens save for retirement, healthcare, and housing. While the contribution rates for PRs and Citizens differ slightly, the CPF system provides various schemes and programs to help both groups save more and achieve their financial goals. It is important to understand the rules and restrictions on the withdrawal and usage of CPF savings, as well as the risks and limitations of the various CPF schemes and programs.

Becoming a Singapore PR is a smart investment for anyone looking to maximise their CPF savings and enjoy the benefits of living in Singapore. With the CPF system in place to help you save for your future needs, taking the first step towards PR status can set you on the path towards a secure and comfortable retirement.

If you’re considering applying for PR, it’s important to have a clear understanding of the immigration process and requirements. That’s where an experienced immigration agency can be of great help. We can guide you through the entire process, from evaluating your eligibility to preparing your application and providing ongoing support. To learn more about how we can assist you, read our article on why should you consider engaging an immigration firm.